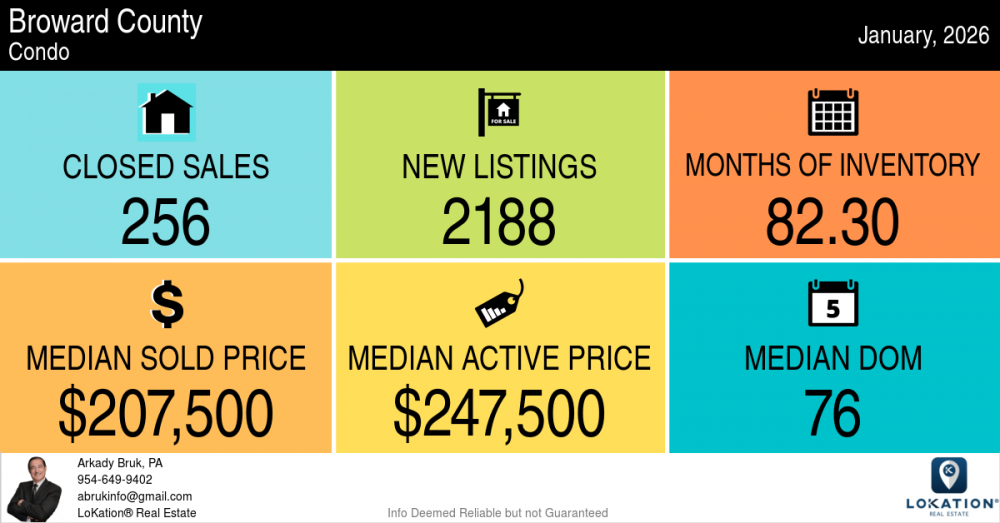

Condos:

Analysis: The Broward condo market continues to exhibit extreme buyer-friendly conditions, with an overwhelming 82.3 months of inventory—a strong indicator of oversupply. New listings far outpace sales, putting pressure on sellers to be highly competitive with pricing and presentation. With a sizable $40,000 gap between the active and sold median prices, price reductions and negotiation leverage favor buyers.

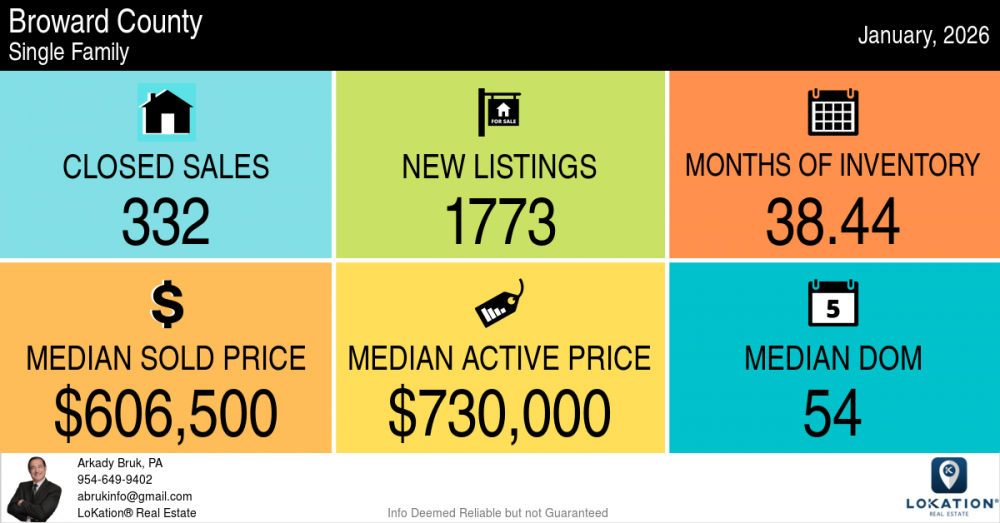

Single-Family Homes:

Analysis: While inventory remains elevated, the single-family home market in Broward shows stronger traction than condos. Closed sales are solid, and median DOM at 54 days indicates decent buyer activity. However, with active prices still significantly higher than sold prices, sellers must price realistically to attract offers in a competitive landscape.

Miami-Dade County

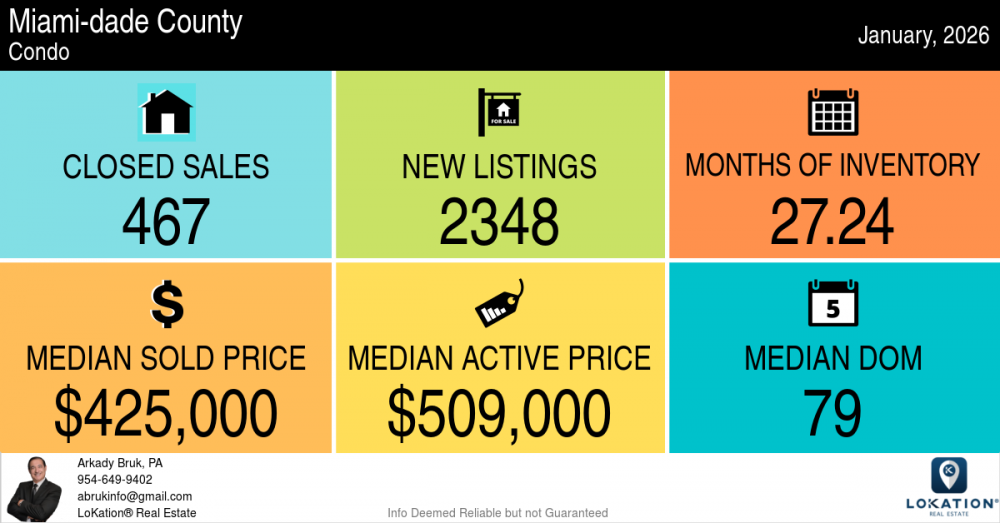

Condos:

Analysis: Miami-Dade’s condo market faces growing inventory and sluggish movement. Despite decent sales volume, new listings continue to outpace absorption. Days on market remain high, and the active-to-sold price gap shows a market still adjusting to pricing realities.

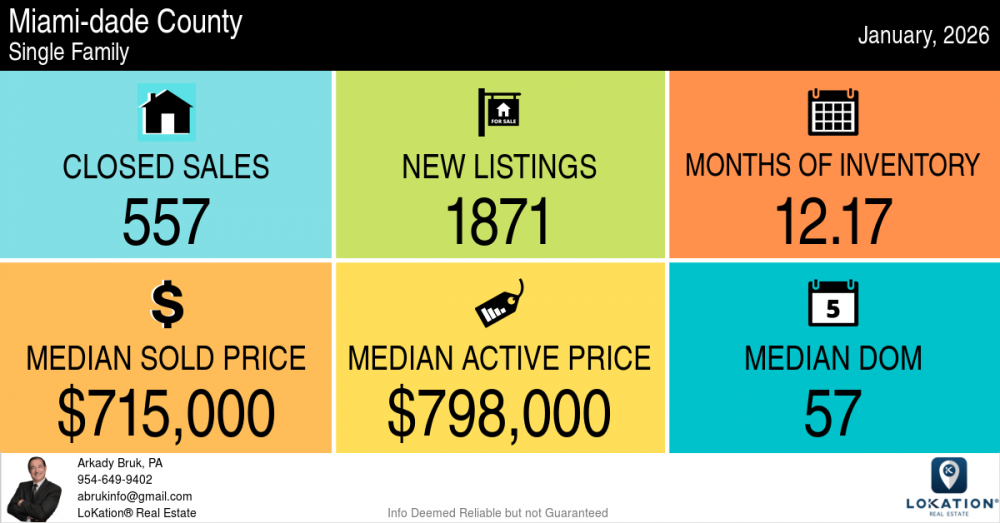

Single-Family Homes:

Analysis: The single-family home segment in Miami-Dade remains healthy, with a relatively balanced 12.17 months of inventory. Homes are selling more quickly than condos, and the price gap is less dramatic. Buyers are active but still cautious—value pricing is key.

Palm Beach County

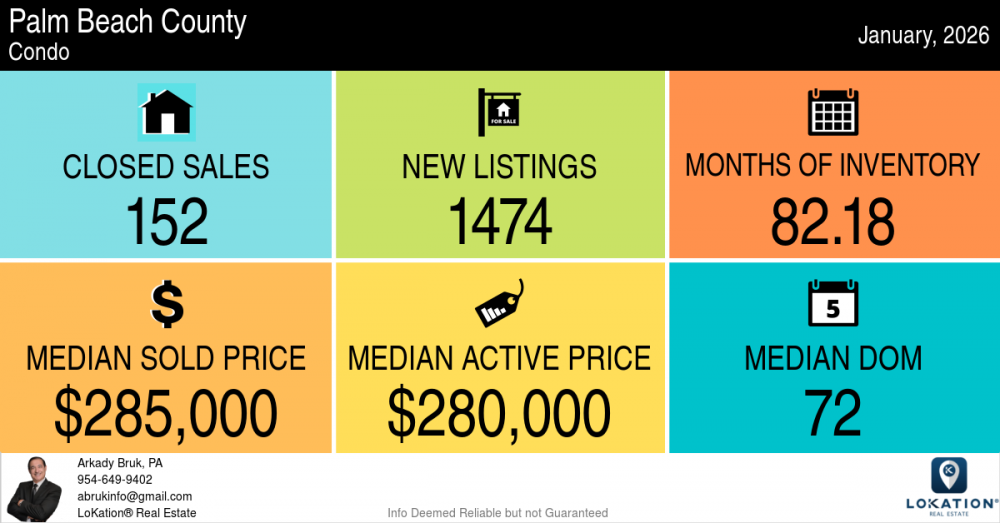

Condos:

Analysis: Palm Beach condos also face massive oversupply, similar to Broward. Interestingly, the active price is slightly below the median sold price, indicating some sellers may be adjusting expectations early. Long days on market affirm the need for sharp pricing and standout listings.

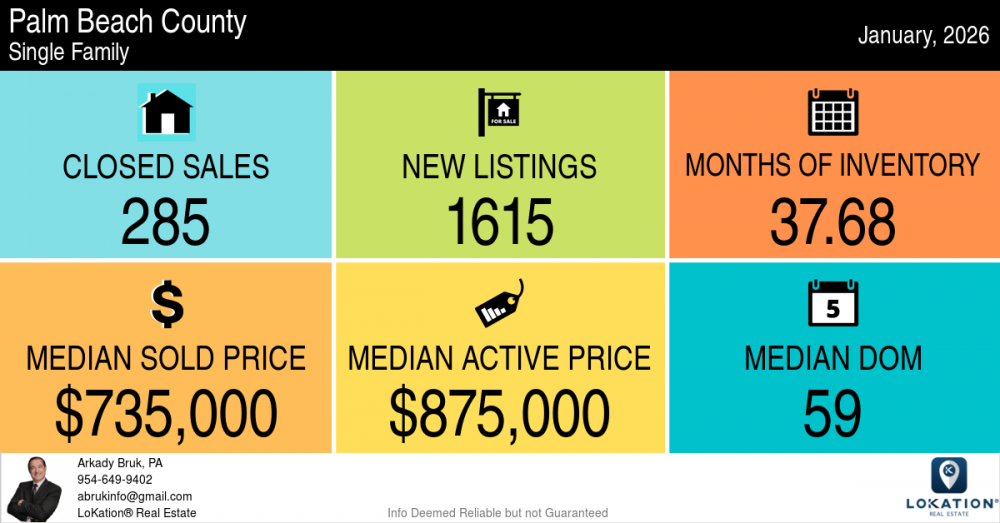

Single-Family Homes:

Analysis: Single-family homes in Palm Beach are seeing moderate sales, though the large gap between active and sold prices ($140K) suggests sellers are still aiming high. With DOM approaching two months and inventory high, competitive pricing and presentation will win the day.

South Florida Real Estate – January 2026 Summary & Recommendations

-

Condo Market:

-

Remains a strong buyer’s market across all counties.

-

Extremely high months of inventory create major leverage for buyers.

-

Sellers must price realistically to avoid listings going stale.

-

Great opportunities for value-seeking and investor buyers.

-

Single-Family Homes:

-

Market shows more resilience and balance than condos.

-

Buyer demand is stable, but price sensitivity remains.

-

Sellers must address pricing gaps to attract serious offers.

-

Well-priced homes are moving, especially those in desirable locations.

-

Actionable Advice:

-

Sellers: Use recent comps, stay flexible, and listen to your Realtor’s pricing strategy.

-

Buyers: Leverage current conditions—more inventory, slower market pace, and negotiability, especially in condos.

-

This is a strategic window for smart moves—before market shifts or competition picks up in spring.